Only 2.5% of Russians visit fitness clubs – results of a recent study of the sports industry

For the third year in a row, the growth rate of the fitness services market has been declining. 2016 turned out to be difficult for the sector: according to RBC analysts, the market grew by 8.3% and reached 110 billion rubles.

The forecasts, however, are rather positive: in 2017 there are reasons to expect growth rates to increase to 11%.

Rice. 1. Forecast of the fitness services market in Russia for 2017, billion rubles, %

Consumer habits

The fitness services industry is always very dependent on consumer behavior. Fitness is closely related to the self-image we strive to project. At the same time, the sector has great growth potential - there are still very few Russians involved in fitness.

RBC Market Research analysts spoke with more than 4 thousand people (distributed by gender, age and geography). Only 9.3% of respondents go in for sports more than once a week. At the same time, the majority do this at home or on the street - only 2.5% of Russians visit fitness clubs.

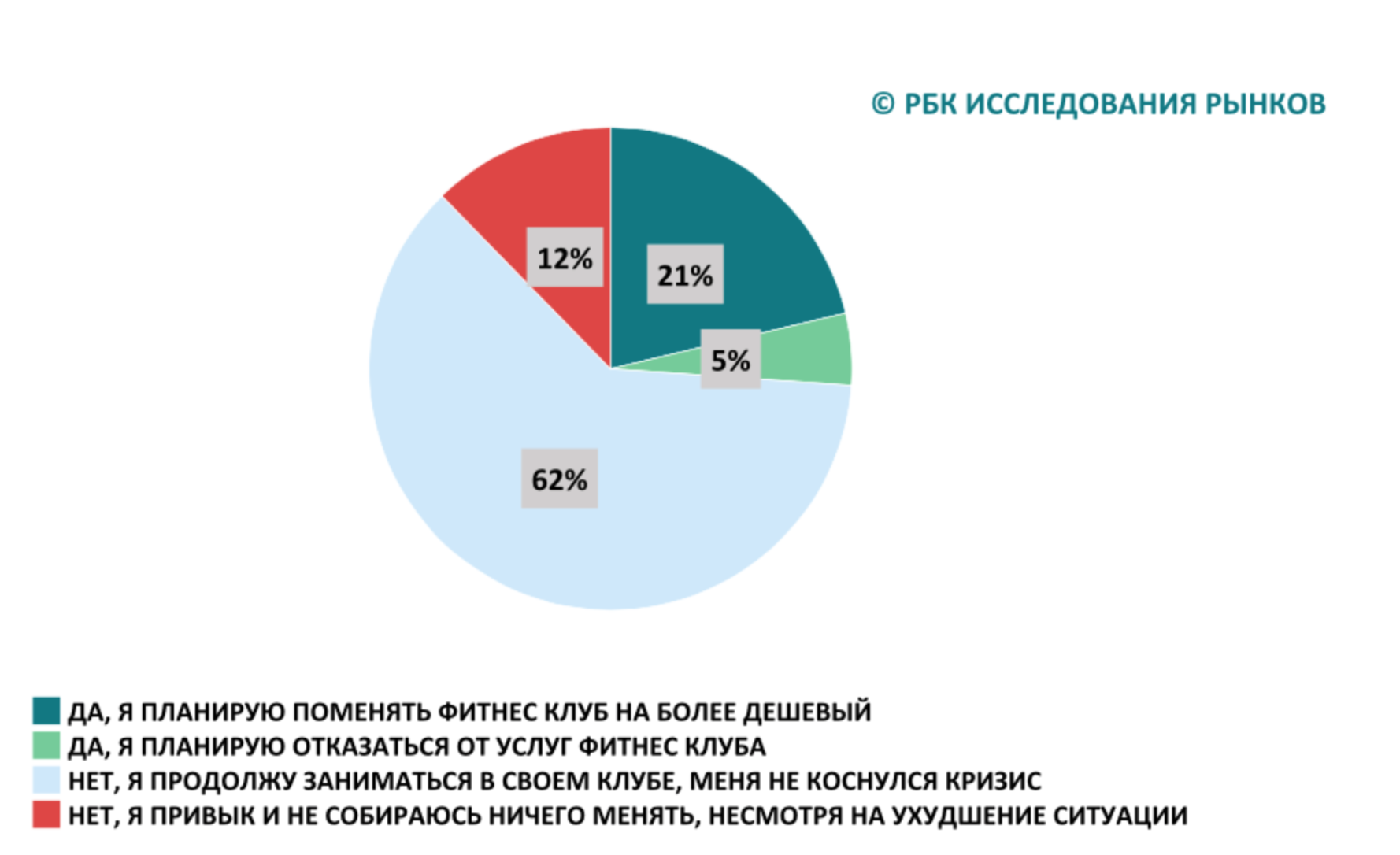

Despite the fall in household incomes (according to Rosstat estimates, the real disposable income of Russians at the end of 2016 decreased by 5.9%), only 4.8% of respondents are now ready to refuse the services of fitness clubs. But a significant portion of respondents are ready to switch to a cheaper fitness club (21.3%).

Rice. 2. Has the crisis affected your plans to visit a fitness club (Russia),%

Research results:

- Fitness studios are gradually gathering a loyal audience: 1.6% of respondents work out there.

- The majority of respondents practice in yoga studios—almost a quarter (23.4%) of the total number of students.

- The second most popular are women's training studios (they were chosen by 18.1% of respondents).

- The two largest chains of studios in Russia (FitCurves and Tonus-Club) occupy a significant share of the network market of women's training studios and are actively developing franchising.

- The third most popular in Russia are dance studios - 16.2% (although many respondents do not consider dancing as a sport, so the actual number of students may be higher).

VR, online sales and area expansion

The digital economy has also come to the fitness sector. Many are introducing innovative products: VR, cinema halls in cycling studios, applications and gadgets for tracking, and so on.

Studios or fitness boutiques are becoming especially popular in the West and are gradually entering the Russian market. In Russia, there were many small halls with a similar range of services before, but classical studios appeared only a few years ago. Now, judging by the interviews of major players conducted for the study, the studio format is interesting to almost the entire market.

There is also an opposite trend – towards an increase in the average area of new clubs. Over the past few years in Russia, almost all new network clubs exceed 1-2 thousand square meters in area. m., and the largest chains even open giant clubs of 7-12 thousand sq. m. meters.

If previously fitness clubs (especially in the upper price segments) hid prices for services and did not disclose them even over the phone, now a trend towards the development of online sales is becoming visible: their share increased last year and this area will expand in the future.

Franchising is becoming an important factor in the further development of the Russian fitness services market - the largest players are going to briefly increase the number of franchisees and develop the regions of Russia and the CIS countries through franchising.