5. PRODUCTION PLAN

* The calculations use average data for Russia

1. PROJECT SUMMARY

The goal of the project is to organize a gym in the low-cost price segment in Moscow, Yuzhnoye Chertanovo metro station. The project has both a commercial and social component, providing affordable healthy leisure for young people. The gym is located on rented space in the basement of a residential building. The target audience is young people (men) aged 15-35 with low and middle income who are interested in sports.

The main prerequisites for the successful implementation of the project are: the growth of the market for sports and recreational services even in times of crisis and the absence of sports facilities in the area under consideration with an extremely high population density.

Investment costs are aimed at purchasing simulators, furnishing the premises, as well as creating a working capital fund, from which losses are covered until the project reaches payback. The main performance indicators are given in Table. 1.

Table 1. Key project performance indicators

2. DESCRIPTION OF THE COMPANY AND INDUSTRY

Gym services are part of the market for sports and health services, which, in turn, is part of the market for paid services. Paid services are an important part of the population's expenditure structure. However, in terms of the share of paid services in the structure of gross expenditures per capita, Russia lags significantly behind developed countries. First of all, this is due to the relatively low level of income and the large share of food costs in it. With an increase in income, the share of expenses on food will decrease, and the share of expenses on paid services will increase.

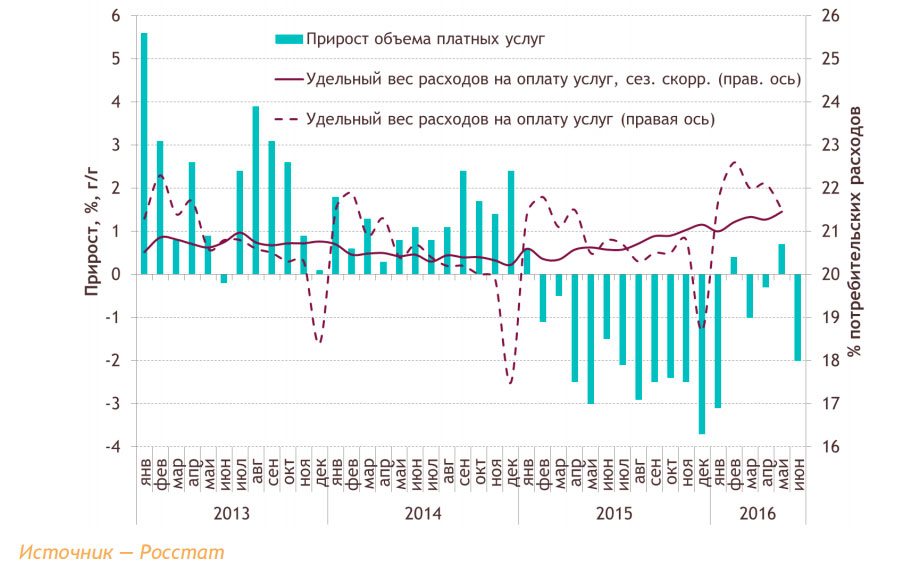

Experts have noted a steady decline in real disposable income since 2014; in the first quarter of 2016 alone they fell by 3.7%. This fall caused a reduction in household spending by 4.3%, which, in turn, had a negative impact on GDP dynamics - it led to a fall in gross domestic product by 1.2% in annual terms.

At the same time, according to analysts (Rosstat and the Analytical Center for the Government of the Russian Federation), the consumption of paid services is highly stable against the backdrop of falling demand for goods (primarily durable goods) - in 2015, demand for services fell by only 2%, in while retail trade contracted by 10%. The volume of the market for paid services in 2015 (the results of 2016 are still being summed up) amounted to 7.9 trillion rubles, which corresponds to 17.3% of the added value of the country’s entire services market.

In the first half of 2016, the rate of decline in demand for paid services slowed down – the decline in demand amounted to 0.9% in annual terms. During certain months (February and May) positive growth rates were observed.

Figure 1. Dynamics of the real volume of paid services to the population in annual terms and the share of costs for services in consumer spending, %, 2013 – 2016.

The largest volume of consumption of paid services falls on three areas: housing and communal services (27.5%), transport services (19%), communication services (16.1%). About 11% comes from household services (vehicle maintenance and repair, home repair and construction, and others). The share of medical services (including sanatorium and resort services) was about 8%, educational services – 6.8%. There is a decrease in the share of three key types of paid services from 65.3% in 2013 to 62.6% in 2015, while in the same period the shares of medical (from 6.9% to 8%) and educational (from 6.9%) increased. 2% to 6.8%) services.

Figure 2. Structure of paid services to the population, quarterly, %, 2013 – 2016

The sports services market as a whole is experiencing certain difficulties, leading to a decline in its volumes. The decline that began in 2014 continues to this day. This is caused by the general deterioration of the economic situation in the country. The annual growth until 2014 was more than 25%, and the potential market capacity was estimated at $2 billion, despite the fact that the market is very far from saturation.

A significant part of the physical culture and sports system is traditionally financed by the state. Until 2014, budget allocations grew steadily, although they were significantly lower than the level of developed countries, where about 2% of GDP is allocated to the industry. In Russia this figure is almost ten times lower. Private investors are showing interest in the market, however, it was not very large even in the pre-crisis period. For the most part, the interest of private investors is more related to personal interests and hobbies than to the formation of a profitable business.

Ready ideas for your business

All organizations operating in the sports and health services industry can be divided into two categories: commercial and non-profit. The former are created for the purpose of making a profit, the latter are aimed at making sports services accessible to the poor. There is currently an imbalance in the market. State funding is aimed primarily at the implementation of large-scale projects (construction of infrastructure for the 2018 FIFA World Cup), as well as small sports structures and institutions (usually financed from the regional budget). Private investors invest money in fitness clubs, the share of which reaches 75% of total investments.

The financial crisis and the fall in real incomes in 2016 also had an impact on the fitness services sector. However, despite this negative impact, the market continued to grow. At the same time, its growth rate, according to some estimates, is very significant for the Russian economy. According to RBC Market Research, in 2015 the fitness services market grew by 14.1% in monetary terms and by 3.6% in real (natural) terms. The total market volume, including related areas (crossfit, individual training) amounted to about 101.5 billion rubles at the end of the year.

The sports services market in Russia has pronounced geographic diversification. There are four main areas: the capital region, where the market is most developed, St. Petersburg with a high level of development, million-plus cities with a young and relatively underdeveloped market, and other Russian cities. As for highly competitive metropolitan markets, research has shown that even when highly saturated, they still have growth opportunities. First of all, this applies to sports institutions with a subscription cost of up to 50,000 rubles, that is, representatives of the Comfort, Economy and Low-cost segments. Speaking about Moscow, we should also note the high saturation within the Central Administrative District, while the outlying residential areas are practically not covered.

Figure 4. Structure of the sports services market in Moscow and the Moscow region, % of total revenue

The project involves the creation of a new business entity and the organization of a gym in the Yuzhnoye Chertanovo district of Moscow. The population of the district is 147,907 people with a high density of 15,147 people/km2. At the same time, there are no establishments of a similar nature in this price category in the immediate vicinity.

Ready ideas for your business

The demand for the project’s services is due to the sedentary lifestyle of a modern city dweller and the need for physical activity. Taking into account the social status of the main part of the population of the region, the choice of the low-cost price segment seems to be the most appropriate.

The gym is focused only on strength training (no cardio equipment), which makes it as compact as possible. In addition to its own training room, there is also a locker room and shower.

3. DESCRIPTION OF GOODS AND SERVICES

The project provides sports and fitness services - classes on strength training equipment and free weights (barbells, weights, dumbbells). In order to save money when purchasing equipment, as well as to reduce the required area of the hall, the emphasis is primarily on working with free weights. The set of simulators is minimal. A list of exercise equipment and free weights is given in Table. 2.

Table 2. List of equipment for classes

|

Name |

Description |

|

|

Exercise bench with barbell and dumbbells |

Versatile bench with adjustable backrest for a wide range of free weight exercises |

|

|

Abdominal and back training bench |

Bench for exercises for training the abdominal and back muscles |

|

|

Bench for bench press |

The athletic bench for bench press is designed for performing exercises with an Olympic weightlifting barbell. The powerful welded structure is designed for loads up to 600 kg. The barbell bench is equipped with retractable telescopic elements. |

|

|

Butterfly chest machine |

Block exercise machine for the development of pectoral muscles |

|

|

Vertical Pull Trainer |

Block exercise machine for the development of the latissimus muscles |

|

|

Horizontal bar and parallel bars |

No-load equipment for a wide range of exercises |

|

|

Barbells, dumbbells, weights |

Free weights of various weights for a wide range of exercises |

There is always a trainer in the gym who can help you create an individual training program (the service is included in the price of the subscription). Individual training is not provided.

The cost of a monthly subscription is 1,000 rubles per person with the possibility of unlimited access to the gym. It is possible to purchase an annual subscription, but there are no discounts on it - the cost is 12,000 rubles.

The area and layout of the hall provide the possibility of comfortable training for 25 people at the same time. In addition to the training room itself, there is also a locker room and a shower room with three stalls.

4. SALES AND MARKETING

The target audience of the project is young people (men) aged 15-35 years old, who are interested in sports of various types, primarily strength and combat (weightlifting, powerlifting, with low and middle income. The price segment of the project is “low-cost” ( it includes sports clubs with an annual subscription cost of less than 15,000 rubles).

The promotion policy is based on the transfer of information about the hall from one visitor to another, which does not require financial costs. To initially attract customers, a bright sign above the entrance, distribution of advertising leaflets at the entrances of adjacent residential buildings, and advertising on social networks are used.

Promotion on social networks involves creating a public advertising page on vk.com, as well as a channel on Instagram. The pages are filled with useful content, as well as information about the hall. Targeted advertising is used. It is also used in the future, after reaching planned sales volumes.

The demand for project services does not have a pronounced seasonality; in financial terms, seasonality is not taken into account; the load is uniform.

Table 3. Planned sales volumes

|

|

PRODUCT/SERVICE |

AVERAGE PLANNED SALES VOLUME, units/month. |

PRICE PER UNIT, rub. |

REVENUE, rub. |

VARIABLE COSTS, rub. |

|

Monthly subscription |

|||||

|

|

|

|

Total: |

250 000 |

There is no competition in the selected territory. There is a network sports club located at the nearest neighboring metro station. However, it has a radically different format and a higher price category - the cost of an annual subscription is 35,000 rubles.

5. PRODUCTION PLAN

The gym is located in a rented space that was previously used as a store. The total area of the premises is 75 m2, of which 40 m2 is allocated directly for the training room. The premises have all connected communications and meet the requirements of supervisory authorities. A minor redevelopment of the premises and shower equipment is required. Most of the renovations are carried out by the project team.

Exercise machines and other equipment for the gym are purchased from one of the large Moscow sports clubs that are modernizing their fixed assets; Thus, all equipment is used, but in very good condition. Delivery and installation of equipment is carried out by the project team.

6. ORGANIZATIONAL PLAN

Individual entrepreneur was chosen as the legal form of the project. The form of taxation is the simplified tax system with the object of taxation “income minus expenses”, rate 15%. An individual entrepreneur is registered with the Federal Tax Service of Russia in accordance with legal requirements.

All management and administrative functions are performed by the project initiator. For this he has the necessary knowledge and skills; The initiator of the project was trained at a school for young businessmen. At the same time, he is a professional athlete, which allows him to work as a shift trainer-instructor. Also, in his free time, he promotes the project on social networks. Accounting has been outsourced. Thus, the organizational structure of the enterprise is extremely simple (Table 4).

Table 4. Staffing and wages fund

|

|

Job title |

Salary, rub. |

Number, persons |

Payroll, rub. |

|

Administrative |

||||

|

Accountant |

||||

|

Industrial |

||||

|

Trainer-instructor |

||||

|

|

Total: |

RUB 32,500.00 |

||

|

|

Social Security contributions: |

RUB 9,750.00 |

||

|

|

Total with deductions: |

RUB 42,250.00 |

||

7. FINANCIAL PLAN

The financial plan is drawn up for a five-year period and takes into account all income and expenses of the project. Revenue refers to revenue from operating activities; income from other activities is not provided for by the project. Revenue from the first year of project implementation is 2.2 million rubles; net profit after taxes – 586.5 thousand rubles. Revenue of the second year and subsequent years – 3.0 million rubles; net profit – 1.25 million rubles.

Investment costs are aimed at preparing the premises, acquiring fixed assets, as well as forming a working capital fund, from which the losses of the project are covered until it reaches payback. The required amount of investment funds is 493,177 rubles. The project initiator’s own funds are 150,000 rubles. The lack of funds is covered by attracting a bank loan for a period of 24 months at 18% per annum. Loan repayment is carried out in annuity payments, loan holidays are three months.

Table 5. Investment costs

|

NAME |

AMOUNT, rub. |

|

|

Real estate |

||

|

Room renovation |

||

|

Signboard (light box) |

||

|

Equipment |

||

|

Exercise machines and other equipment |

||

|

Intangible assets |

||

|

Working capital |

||

|

Working capital |

||

|

|

Total: |

RUB 493,177 |

|

|

|

|

|

|

Own funds: |

RUB 150,000.00 |

|

|

Required borrowings: |

RUB 343,177 |

|

|

|

|

|

|

Bid: |

18,00% |

|

|

|

|

|

|

Duration, months: |

|

It seems extremely difficult to determine the variable costs for one monthly subscription; for this reason, all project costs are classified as fixed (Table 6). In addition to other expenses, fixed costs also include depreciation. The amount of deductions is determined by the linear method based on the useful life of fixed assets of five years.

Table 6. Fixed costs

A detailed financial plan is given in Appendix. 1.

8. EVALUATION OF EFFECTIVENESS

The assessment of the effectiveness and investment attractiveness of the project is carried out on the basis of a detailed analysis of the financial plan and cash flows, simple and integral indicators of the project’s effectiveness are calculated (Table 1). To account for changes in the value of money over time, the discounted cash flow method is used; The discount rate is equal to the risk-free rate (yield on long-term government bonds) – 7%. The low level of the discount rate is justified by the presence of not only commercial but also social goals for the project.

The simple (PP) and discounted (DPP) payback period of the project is 10 months. Net present value (NPV) – 553,074 rubles. Internal rate of return (IRR) – 12%. Profitability index (PI) – 1.12. All these indicators indicate the effectiveness and satisfactory investment attractiveness of the project.

9. WARRANTY AND RISKS

To assess all possible risks associated with the implementation of the project, an assessment of all external and internal factors is carried out. Taking into account the extremely small size of the business, its autonomy, the low volume of fixed costs, as well as its belonging to the service sector (lack of production, goods in stock, etc.), two main risk factors can be identified:

Injuries to visitors during training, accidents - to neutralize this threat, each new client undergoes mandatory safety training; the trainer-instructor is constantly in the hall and monitors compliance with safety rules

Entry into the market of a competitor in the same price segment, geographically close - this option seems unlikely; it is more likely to open a gym or sports club of a higher price category; At the same time, the loyalty of the project’s regular customers is beyond doubt.